Dynamic growth & unprecedented challenges

In 2019, the Myanmar apparel industry exported 6.7 billion USD worth of garments, footwear and handbags, an increase of 26% on the previous year

A total of 123 new apparel production and processing factories registered with the Directorate of Investment and Companies Administration between January and December 2019. A majority of existing production sites seemed to also continue an expansion of production capacities.

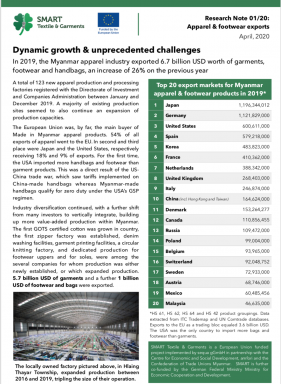

The European Union was, by far, the main buyer of Made in Myanmar apparel products. 54% of all exports of apparel went to the EU. In second and third place were Japan and the United States, respectively receiving 18% and 9% of exports. For the first time, the USA imported more handbags and footwear than garment products. This was a direct result of the US- China trade war, which saw tariffs implemented on China-made handbags whereas Myanmar-made handbags qualify for zero duty under the USA’s GSP regimen.

Industry diversification continued, with a further shift from many investors to vertically integrate, building up more value-added production within Myanmar. The first GOTS certified cotton was grown in country, the first zipper factory was established, denim washing facilities, garment printing facilities, a circular knitting factory, and dedicated production for footwear uppers and for soles, were among the several companies for whom production was either newly established, or which expanded production. 5.7 billion USD of garments and a further 1 billion USD of footwear and bags were exported.

Impacts of COVID-19 in early 2020

Despite strong growth throughout 2019, any forecast for the Myanmar apparel industry in 2020 is dire. Production in January was unaffected, but supply chains began to be disrupted in February, and especially in March, as production input materials from China (fabrics & accessories) became increasingly less available. Factories slowed production and several closed entirely. This was followed in late March and April by a wave of further factory closures and mass worker layoffs as retailers in Europe, the United States, Japan and elsewhere began to cancel orders, some invoking force majeure clauses to exit contracts.

Before the CoVID-19 crisis began to negatively impact on the Myanmar apparel industry in February 2020, production capacities had swelled to approximately 690 factories employing over 700,000 workers. By April 2020 this number had rapidly fallen to about 640 active factories employing around 630,000 workers, with the further outlook for May onwards looking grim. If retailers in Europe and the United States are able to resume relatively normal sales operations by the middle of 2020 then the growth inertia of the Myanmar apparel industry might allow for a rapid rebounding. However, some industry analysts predict international apparel industry supply chains might be permanently affected by the COVID-19 disruptions in ways which can be difficult to assess at present. It is anticipated that even more production will leave China in consequence. Japan, for example, recently included 2.2 billion USD of assistance to Japanese manufacturers in China who wish to relocate factories to Japan or Southeast Asia. This is part of Japan’s economic stimulus bill aimed at mitigating negative effects from CoVID-19.

Click below to download the full research note as a PDF.